In most industries, commissioned contractors get paid upon delivery of a product or service. This can make it difficult to track revenue and costs on a single project, let alone many. Construction bookkeeping, while challenging, is an essential part of running a construction company. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice.

Pros and cons of the best construction accounting software

Have you ever wondered how the construction industry, with over 919,000 establishments and 8 million employees in the U.S. alone, keeps track of its finances? The construction industry creates nearly $2.1 trillion worth of structures each year, making it a major economic player. Payroll also often https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects includes a variety of bonuses, benefits, and other incentives, such as overtime pay or extra pay for hazardous working conditions.

Billing method #4: AIA progress billing

As a result, job cost tracking and contract management is crucial, which some general accounting software solutions may not be able to offer. If a construction and service business were to disregard construction accounting practices and only use general accounting practices, they may encounter a number of issues, which affect their profitability and cash flow. Job costing is critical for tracking the financial progress of construction projects. Construction accounting software should facilitate detailed job costing that can automatically allocate expenses by project, task, and material, allowing project managers to see exactly where money is being spent. This feature helps in identifying cost overruns early, ensuring that projects stay within budget and maintain profitability.

What does a construction accountant do?

- Construction accounting software should facilitate detailed job costing that can automatically allocate expenses by project, task, and material, allowing project managers to see exactly where money is being spent.

- With this method, the contractor doesn’t report on income and expenses until project completion.

- And even if changes do happen, they are unlikely to affect the cupcake business’s financial bottom line.

- In other words, contractors need to find ways to reduce mounting costs when changing job sites.

- It is a way to forecast a project’s costs by estimating things such as contractors, materials and supplies, and overhead.

- The percentage-of-completion method is commonly used under GAAP for long-term construction contracts, allowing revenue and expenses to be recognized as the work is performed.

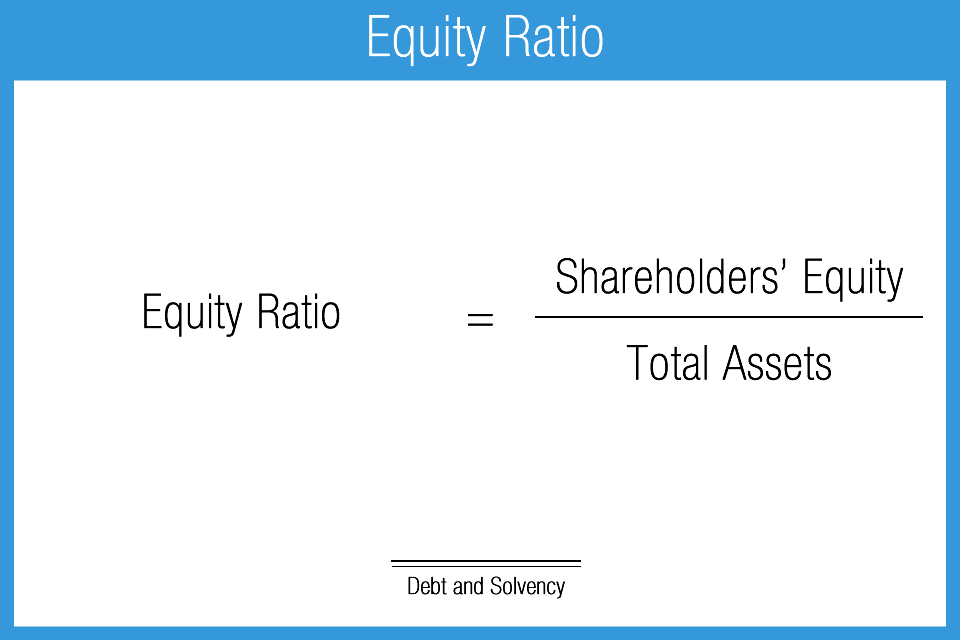

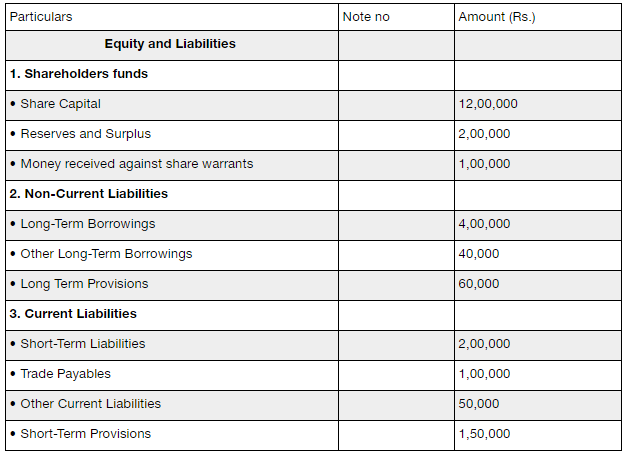

When third parties review finances, the main basis for their decision-making is typically a construction firm’s working capital ratio—the central indicator of the health of your business finances. The debt-to-equity ratio is used as a standard for judging a company’s financial standing and its ability to repay its obligations. This kind of data is the bare minimum for any construction firm that wants to stay on top of it all rather than lurch from one financial challenge to the next.

- If you manage projects, you probably hear “objectives and deliverables” a hundred times daily.

- The purpose of the Act is to protect local wages from being undercut by out-of-area contractors and construction workers.

- The nature of construction work means even the best plans are regularly torn up or rejigged.

- It will ensure you have capital in the event that a customer withholds money owed.

- It aims to make international financial reporting transparent, comparable, and consistent.

Develop an easy-to-follow system and create a habit of recording each transaction at the end of each workday. After all, construction is an industry where so much effort goes into securing work, building and maintaining professional contacts, and actually getting the job done to your client’s—and your own—satisfaction. This way profits can be assured because there’s a constant measurement The Significance of Construction Bookkeeping for Streamlining Projects of the actual on site costing compared to the contractual amounts. Some of this is the same kind of traditional number crunching, as seen in any business, but much of it relates to the project work undertaken by construction firms.

- Topic 606 is an accounting standard update (ASU) that requires public companies to disclose information related to their revenue recognition practices.

- Therefore, the payroll needs to adapt to the changing site conditions and other requirements on the go.

- Accounts receivable are the legal claims for payment of those unpaid services and goods.

- Effective construction bookkeeping is not just a compliance necessity; it’s a strategic asset that drives profitability, fuels growth, and empowers informed decision-making.

Finding an accountant to manage your bookkeeping and file taxes is a big decision. The Davis-Bacon Act (DBA) is a United States law that requires employers to pay prevailing wages—the regional minimum pay requirement—on public works projects for laborers and mechanics. In this construction accounting 101 guide, we covered everything you need to know about this complex yet profitable sector. For instance, all of the income of the partnership needs to be reported as it was distributed to the partners. As a result, each partner shares in the losses and profits of the joint partnership.